|

The natural and comprehensive way to see the flow of the Market…Early detection of the volume clustering within a small price range along with observation of how the volume distributes over time and price are the basic purposes of this add-on. It has various facilities to achieve these goals:

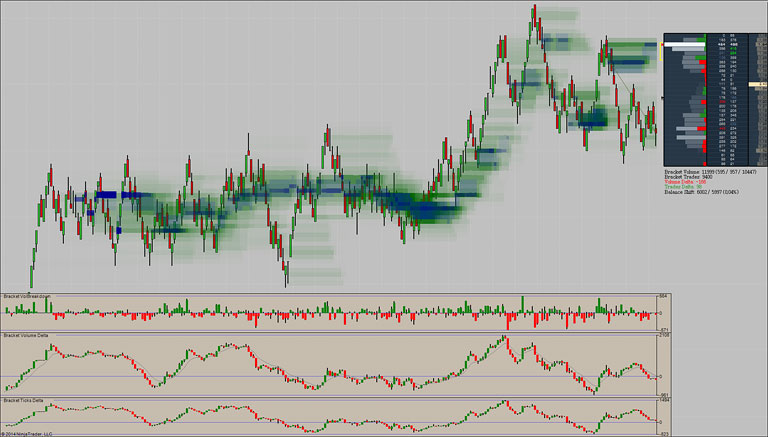

All computations are based on the most recent trades (a group of recent trades of constant total volume hereinafter referred to as the Bracket). The Bracket represents a such quantity of the most recent trades that are amounting to user-specified value in the sum of its volume (see the ‘Bracket Volume Threshold’ parameter). However, even emphasizing in that way on what the market is doing right now the add-on has natural handy tools of showing the past. For instance, such Bracket-based basic concept makes it possible to implement such valuable visual tool as on-chart mapping that has two most interesting forms in this version: the gradient map of volume distribution and the gradient map of average trade size. In addition, the classic bands of volume-based Value Area and Point of Control are available for use.

So, Volume Nodes Detector overgrew its name and was turned into a versatile tool where all numerous functions complement each other harmoniously. General Parameters1. Bracket Threshold Volume and 2. Reinitialize at Session BeginningThe “Bracket Threshold Volume” parameter limits the volume of the Bracket. As mentioned above, the Bracket is just an abstraction representing the most recent trades that are having in total the volume equal (or not exceeding) the specified value of the “Bracket Threshold Volume” parameter. This parameter has an influence on all parts of the indicator: volume map, volume/tick profiles, volume/tick delta sub-graphs. The threshold value you should use depends mainly on the liquidity of your chosen instrument. There is no strict rule on this, however there are standard recommendations for intraday traders which might be helpful (at least to be aware on): A simple rule of thumb to define a suitable ‘Bracket Threshold Volume’ value is to set it to 1/10…1/5 of average daily volume of traded instrument. This gives around 10000 to 30000 contracts for 6B and CL, or 100 000 to 200 000 for ES, for instance. Sure enough, this value has an influence upon the range and sensitivity of the Bracket. The more the threshold volume the wider the range and less the sensitivity to the most recent changes in price & volume. VND is too customizable, so, what settings to choose is actually dependent on your trading style and thereby on what you’re attempting to track on your chart. The “Reinitialize at Session Beginning” parameter defines whether the Bracket (i.e. all related volume/tick profiles and calculations of delta sub-charts) be cleared and rebuilt over again starting from the beginning of each session or it should be calculated continuously.

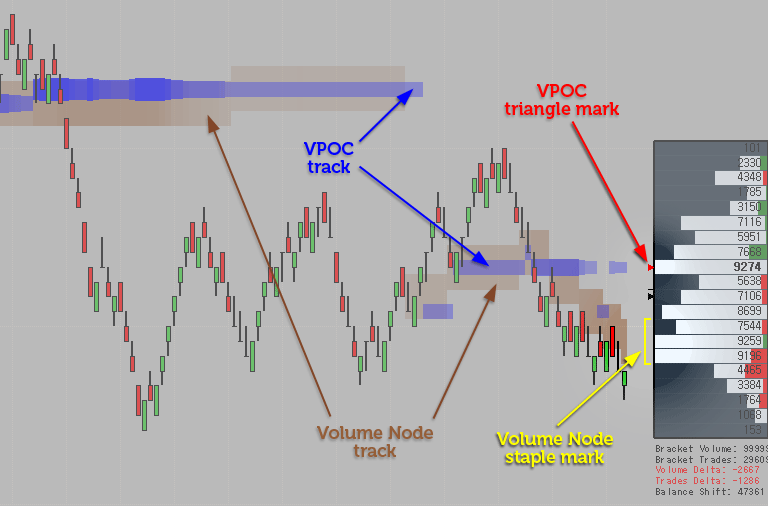

3. Number of Ticks of Volume NodeCommon Volume-based Point of Control (VPOC) is just one tick wide. So, estimation of the VPOC value is a simple way of volume congestion analysis, but it is not such robust way as to be hoped for, especially when it comes to fast and highly volatile instruments. The Volume Node is a more robust alternative to the VPOC. The Volume Node relates to several ticks instead of just one and represents an area where the most trading occurred (within the Bracket naturally). You can observe location and migrations of Volume Node by using both the “staple” mark at the side of the multi-profile and the track on price chart.

General Appearance Parameters

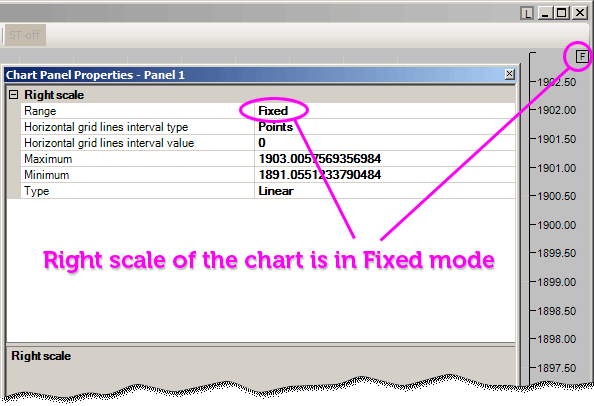

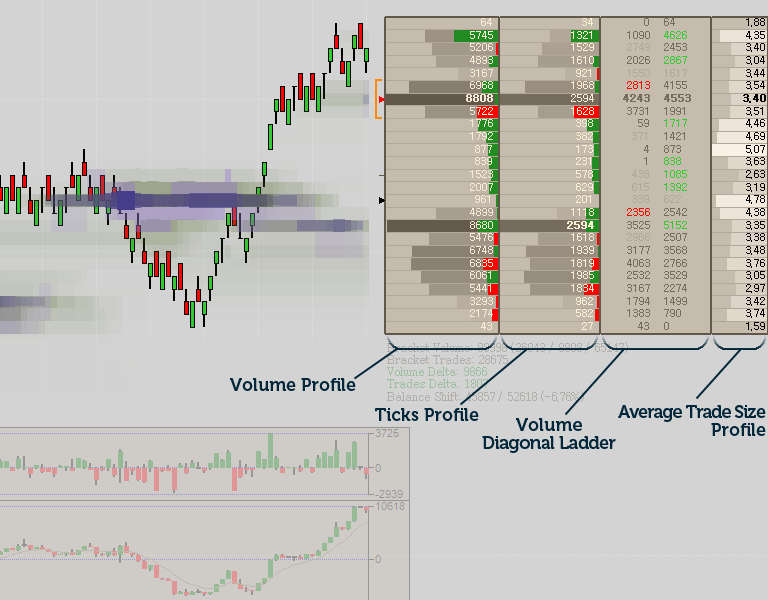

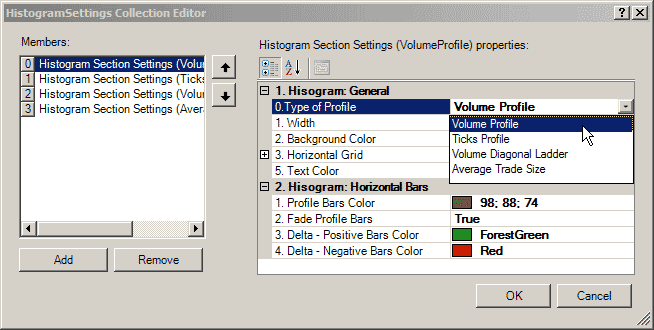

The corresponding toggle button on the toolbar of a Chart window makes it possible to switch the “View Tracking” mode on-the-fly without needing to get into the “Indicators” settings window. The function of view tracking is smart enough to take into account the height of sub-panes. When applying two instances of the Volume Nodes Detector to the same chart you can have the “View Tracking” function enabled in both of them without negative consequences. But it is good practice to enable this function in only one instance of the Volume Nodes Detector (in that one that has sub-panes). 3. Value Area. This expandable property allows you to customize visual appearance of the bands of developing volume-based value area: Value Area High and Value Area Low. Value Area (VA) is the price range in which a specified percentage of all volume was traded within the Bracket. You can find many sources of information on Volume Profile and classical principles of volume analysis everywhere on the Internet. We can recommend the Peter Steidlmayer’s educational video for a good start. Multi-ProfileMulti-Profile is a sort of container that can be composed of an unlimited number of profiles (histograms, ladders) of one of four different kinds: Volume Profile, Ticks Profile, Volume Diagonal Ladder, Average Trade Size Histogram. General Appearance Settings of Multi-Profile

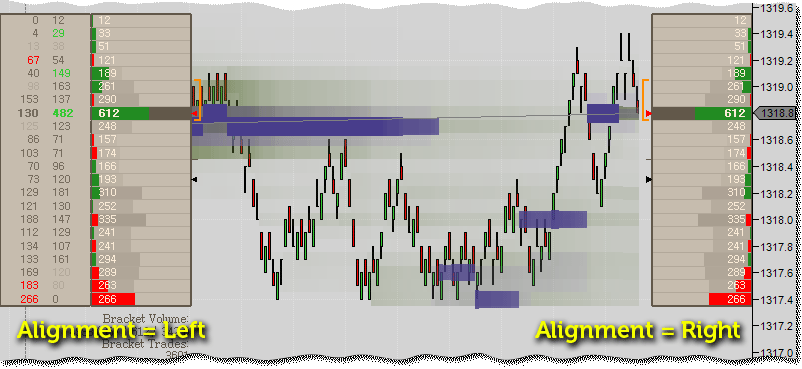

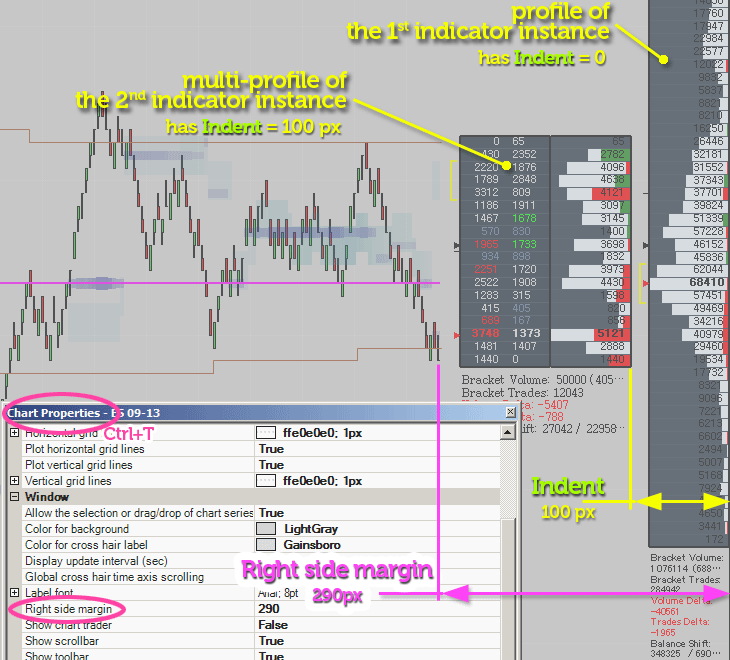

2. Indent Size. Sets the amount of indent from the border of the chart.

Bracket Volume: Total (Above VPOC / VPOC Value / Below VPOC);

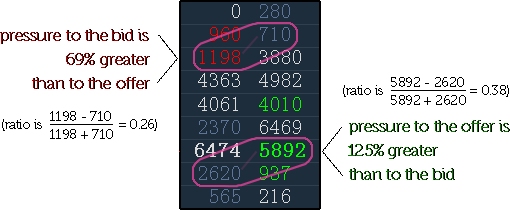

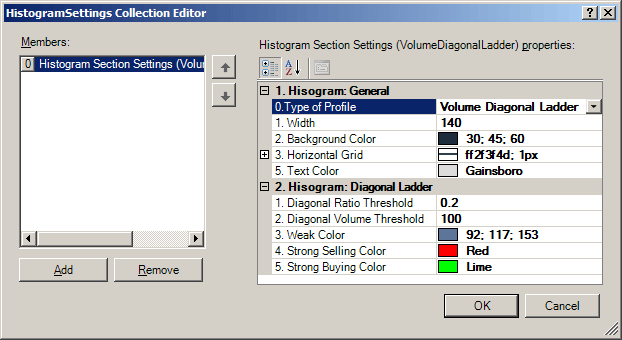

There are currently four types of sections you can choose from: Volume Profile, Ticks Profile, Volume Diagonal Ladder, Average Trade Size (ATS) Profile. Three of them (Volume, Ticks and ATS Profiles) have mostly similar settings because of similarity of visual representation. Volume Diagonal Ladder is a kind of Bracket-based volume footprint (aka bid-ask ladder) that uses a particular approach to coloring the bid and ask values. Managing histograms: Volume Diagonal LadderThis simple bid-ask ladder uses coloring based on “diagonal” ratio between the bid value and the corresponding ask (offer) value. In other words, the bid value is compared with the offer value located right above, and then, if the difference (or ratio) exceeds some predefined threshold, then it means we have a significant volume imbalance between that particular bid and ask. So, such diagonally imbalanced bid-ask pairs will be highlighted by noticeable colors (see the “Strong Selling Color”, “Strong Buying Color” and “Weak Color”). All bid-ask diagonal pairs that are not imbalanced will be colored by the ‘neutral’ “Text Color”.

Volume Maps & TracksTo track price levels of volume congestion you can use both VPOC Track and Volume Node Track. In addition you can use such order-flow mapping tools as Volume Profile Map and Average Trade Size Map. All tools has similar setting and computation modes. VPOC TrackAs it was mentioned, Volume Point of Control (VPOC) is the price level where the most volume was traded within the Bracket.

Volume Node TrackAs it was mentioned, the use of Volume Node Track instead of VPOC Track might appear to be more appropriate way for an analysis of volume congestion when working with fast and volatile instruments like GC or CL. Volume Node (VNode) relates to several ticks instead of just one and represents an area within the Bracket where the most trading occurred.

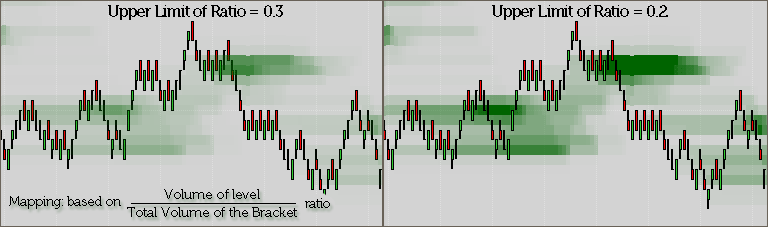

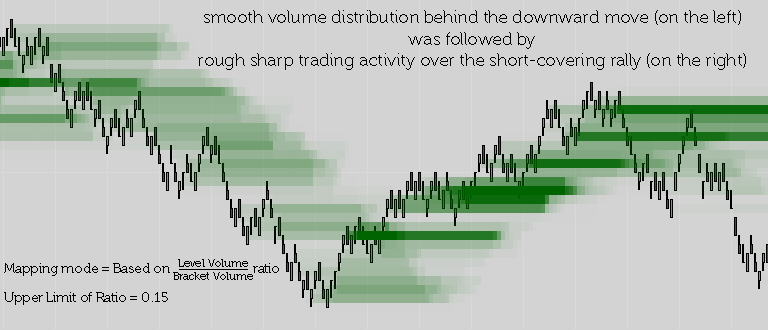

Volume Profile MapThis kind of order-flow mapping implements shading of all price levels within the Bracket in accordance with the volume traded on each particular level.

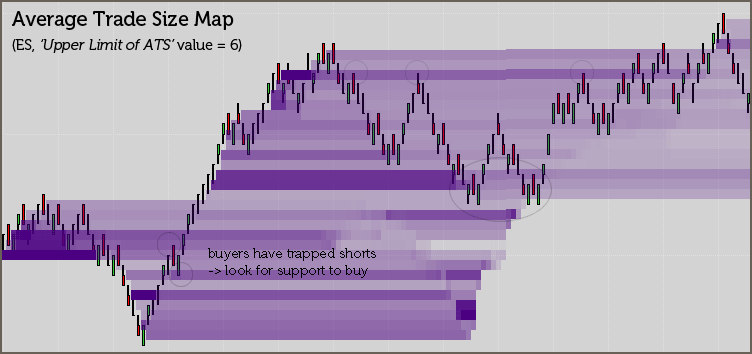

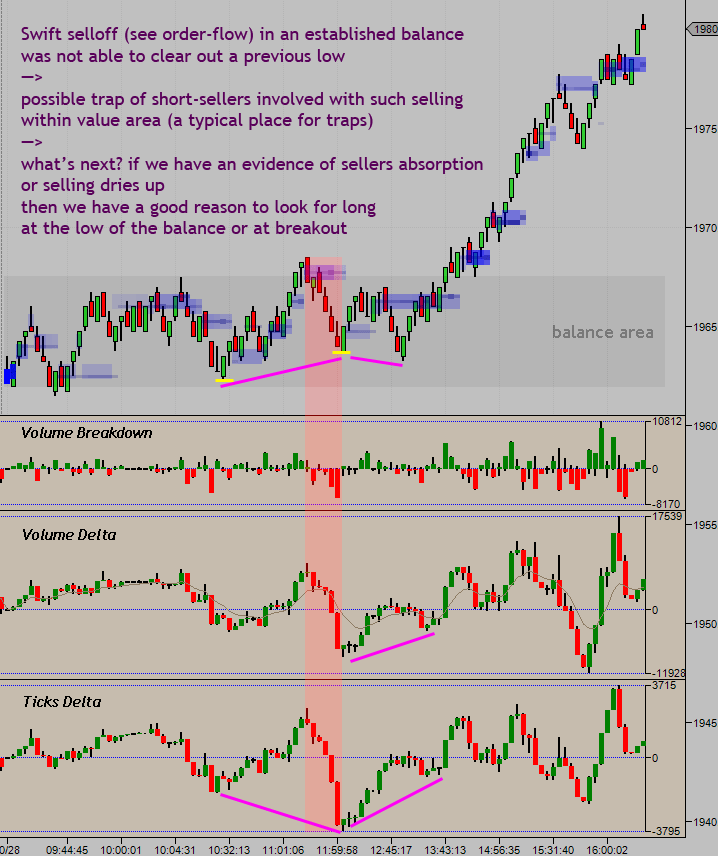

TipWhat is the difference between these two mapping modes in practical applications? At the same time, the second mapping mode is based on volume normalization relative to the total volume of the Bracket. While being destined to show distribution of volume traded, such approach reveals also how a character of distribution was being changed over time. Average Trade Size MapThis is the experimental kind of order-flow mapping. Sub-PanesSub-Panes are serving to display up to three similar order-flow metrics in a traditional form of candlestick charts. Those metrics are: As you may have guessed, all of them are calculated for the Bracket. 1st — Bracket Volume BreakdownBracket Volume Breakdown shows how the volume delta (buying versus selling pressure) of the Bracket was varied on each particular bar separately. 2nd — Bracket Volume DeltaBracket Volume Delta shows the volume delta accumulated for the Bracket. Calculating the cumulative delta for the Bracket makes it similar to an oscillator-like indicator. 3rd — Bracket Ticks DeltaBracket Ticks Delta shows the ticks delta accumulated for the Bracket — the difference between the total number of trades at offer and the total number of trades at bid within the Bracket. It also works like an oscillator. So you can use both volume and ticks delta to reveal divergence/convergence between price and order-flow.

|