OrderFlow Trading Tools

Latest from the Blog

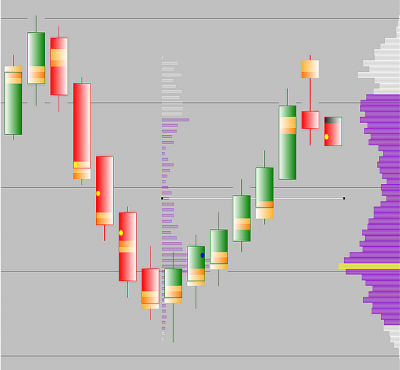

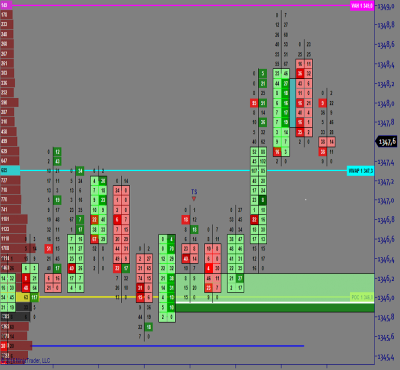

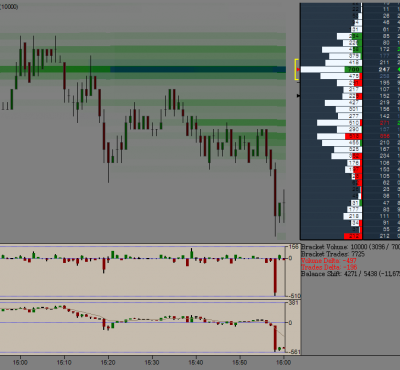

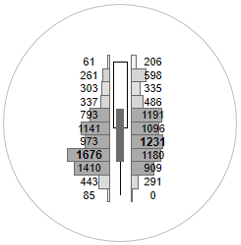

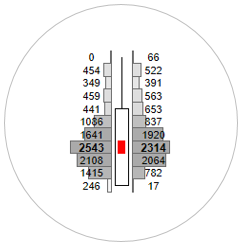

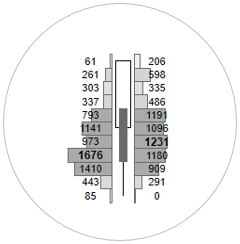

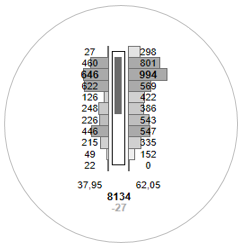

OrderFlow & Reading the Delta

Trading order-flow is one of the only ways you can really “see inside the bars.” Buying and selling pressure is much easier to spot when it’s right there in the numbers in front of you, printing in real-time. The OrderFlow software makes pressure imbalances obvious... Read More

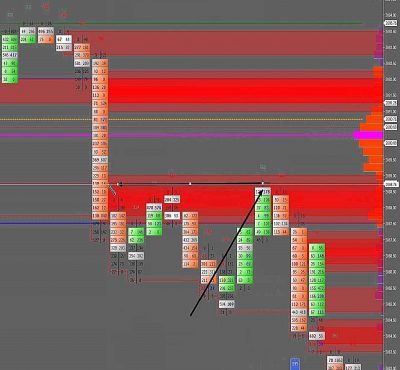

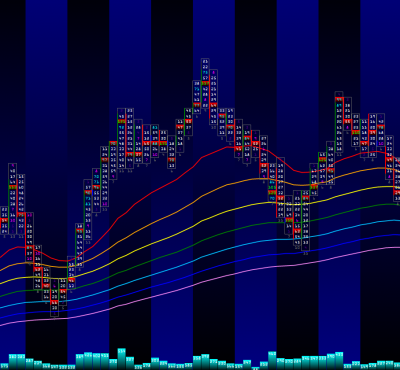

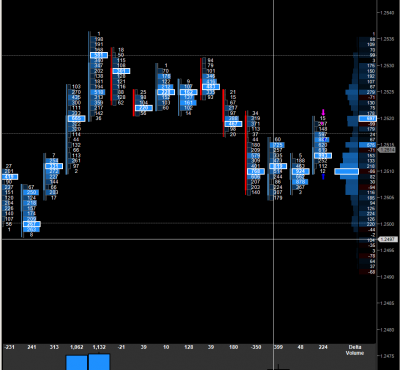

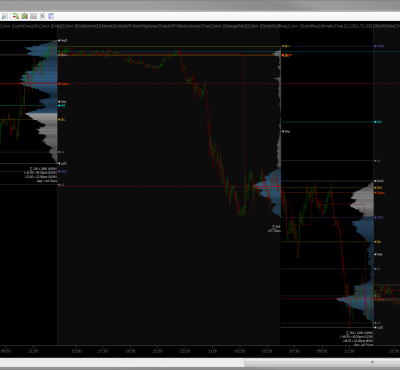

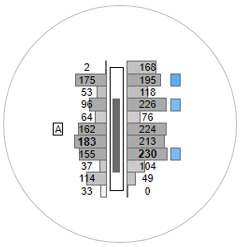

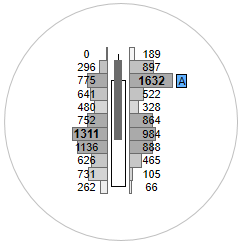

Footprint Charts and How they’re Commonly Used

The most common problem traders face when reading technical charts is determining the right profit- taking and stop loss points. The market ‘noise’ caused due to short-term volatility most often triggers a panic response due to which... Read More