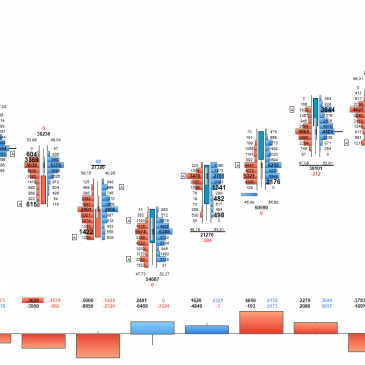

Institutions Know Exactly When The Market Is Running Out Of Aggressive Institutional Buyers And Sellers — Do You?

You are NOT in a fair fight trading currencies… Governments, Central Banks, Hedge Funds, and Institutional Traders are trading on black-ops-like currency intel you can only dream of. While you, the ordinary retail Forex trader: Have to sit. Wait. Then, react to their every move… Always 1, 5, 8 minutes … Read More