You are NOT in a fair fight trading currencies…

Governments, Central Banks, Hedge Funds, and Institutional Traders are trading on black-ops-like currency intel you can only dream of.

While you, the ordinary retail Forex trader:

Have to sit.

Wait.

Then, react to their every move…

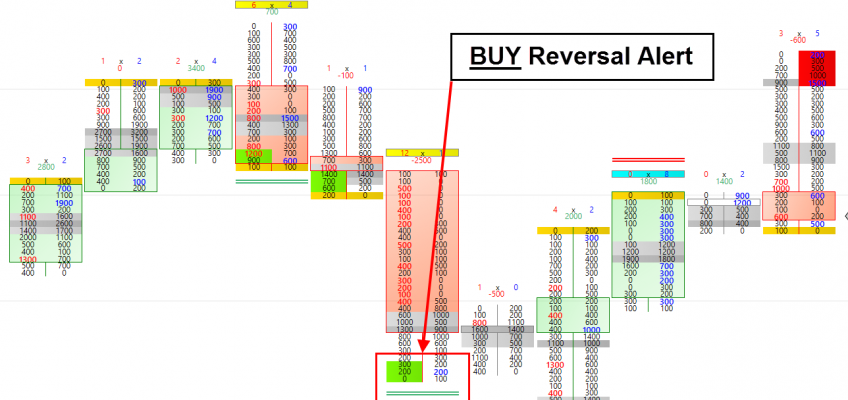

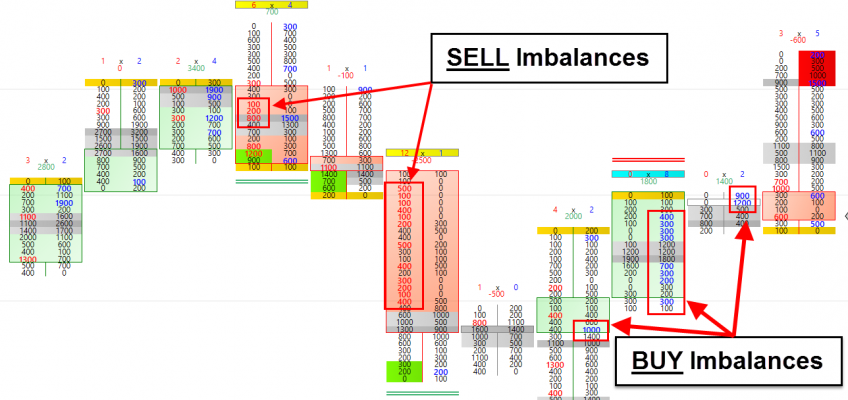

Always 1, 5, 8 minutes after they’ve decimated your trade plan. Or blown up your trade setups, and reversed the price with the sheer unseen volume of their aggressive buying and selling.

Making matters worse:

The Forex market is NOT regulated.

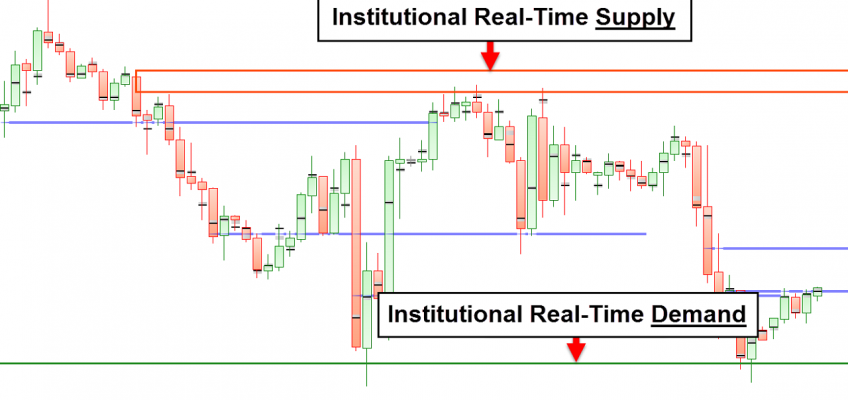

So the 8 biggest Liquidity Provider (Banks) make the market for both the buy and sell side of every Forex transaction, with an unchecked bias towards those trading truckloads of currencies.

This makes you a blind man in a 1-on-8 fight club match over prices. As you wait for the next institutional blow to the gut of your trading account.

Unfortunately:

Most retail Forex traders think they can stop these price beatings with better patterns, volume and

price-based indicators that promise to find and confirm ‘trends’.

But here’s the open secret they don’t get about HOW these behemoth market-movers profit from Forex…

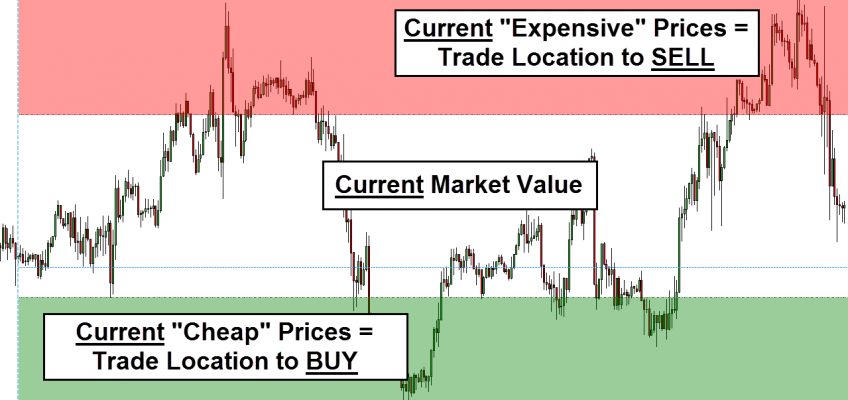

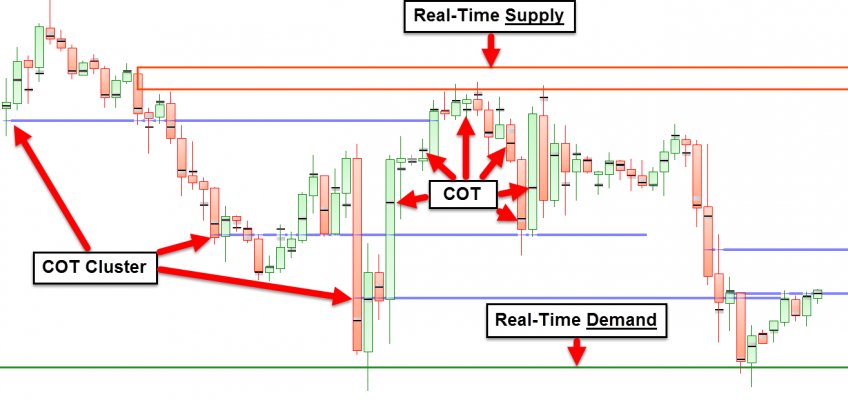

The mighty Banks, Hedge Funds, and Institutional Traders with their aggressive buying and selling — never use indicators to follow trends.

They create the trends!

And use institution-grade currency analytics to expertly set up 3:1, 5:1, 10:1 risk / reward returns — all before your favorite candlestick pattern finishes the first bar of confirmation.

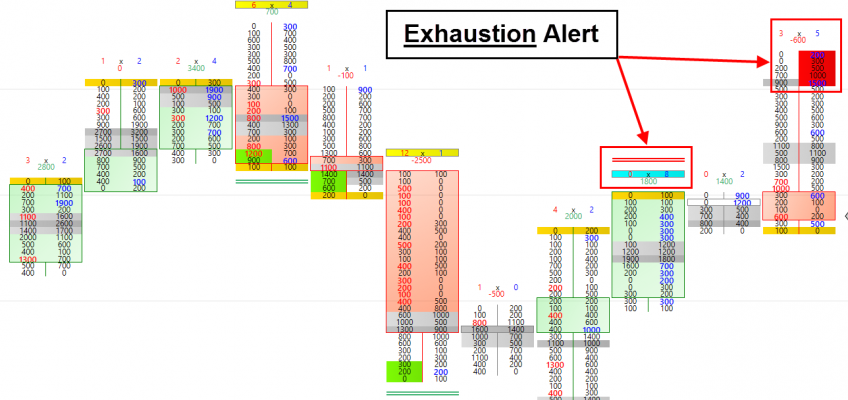

Thus, ensuring they buy and sell off their multi-million-dollar positions — before the market runs out of steam.

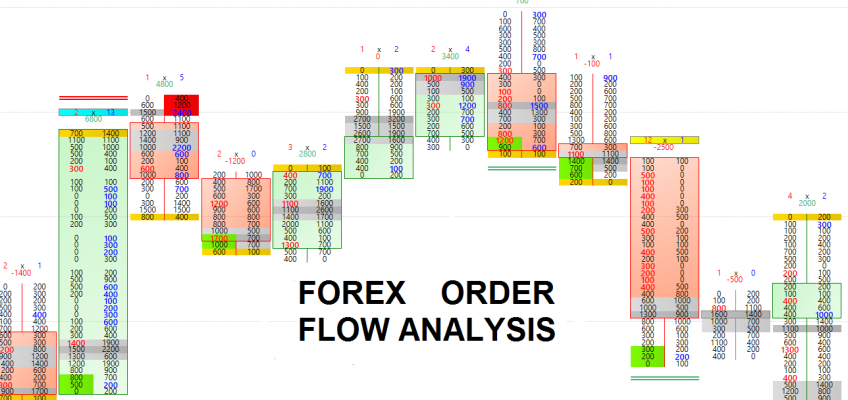

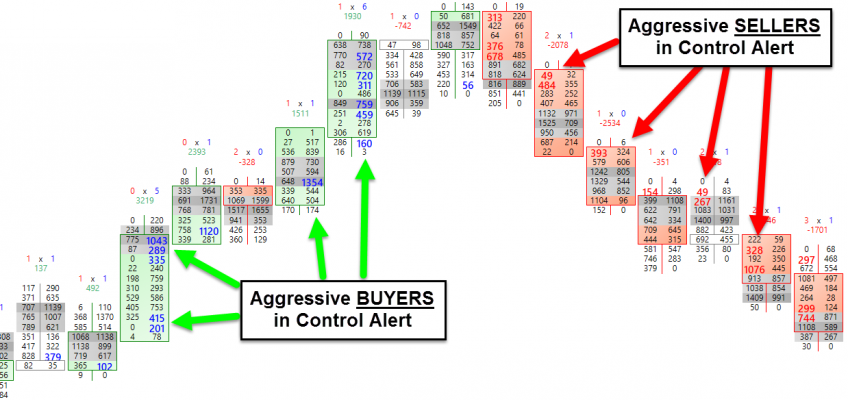

Institutions Know Exactly When The Market Is Running Out Of Aggressive Institutional

Buyers And Sellers — Do You?

Aggressive buyers’ and sellers’ currency trading is what drives volume and wild price swings.

This begs the question: at what point is someone considered an aggressive buyer and seller?

(HINT: it’s not you trying to unload your 1/10 fractional EUR/USD contract.)

It’s Governments, Central Banks, Hedge Funds, and Institutional Traders who make up 90%+ of the daily volume for any currency pair…

And like the merciless warlords of the market they are — they see every move other commercial traders & institutions make (and now you can too!) :

Leave a Reply