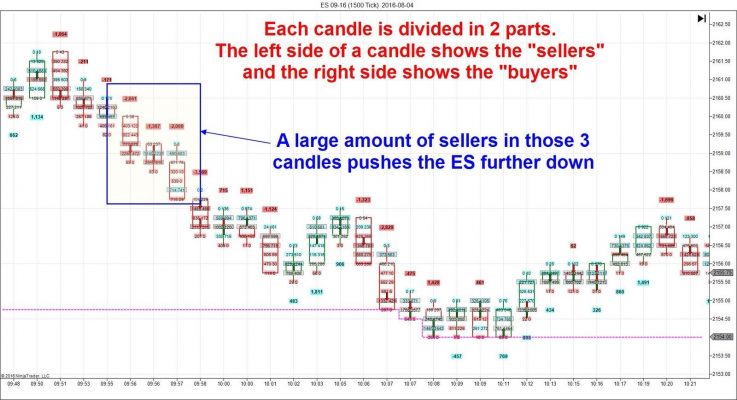

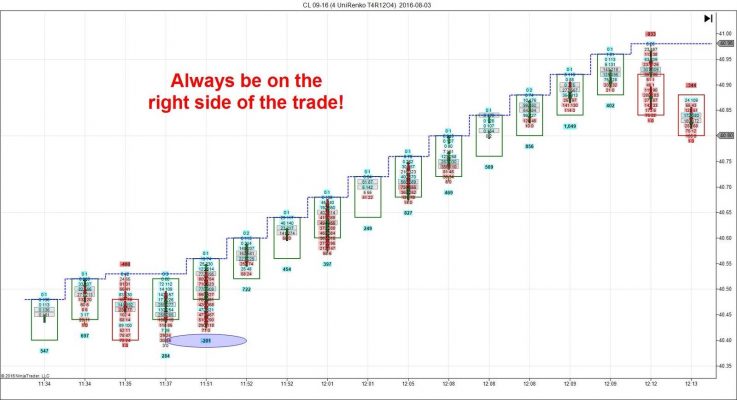

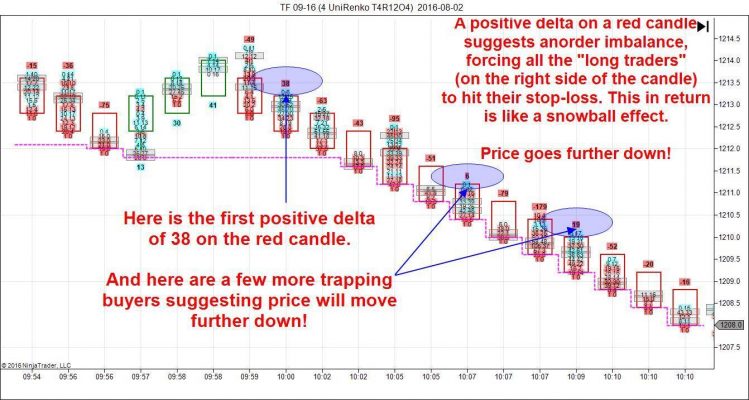

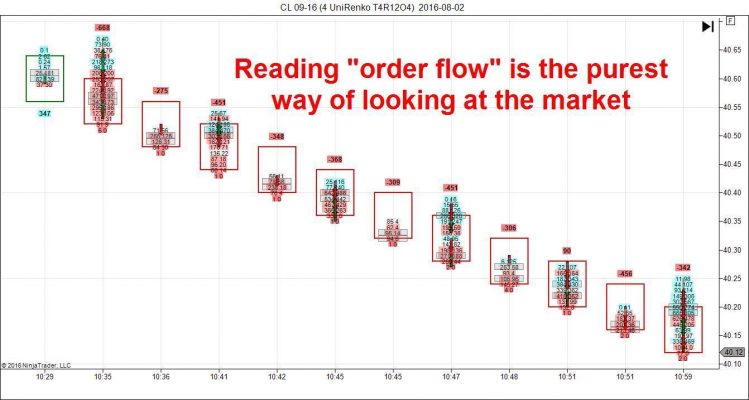

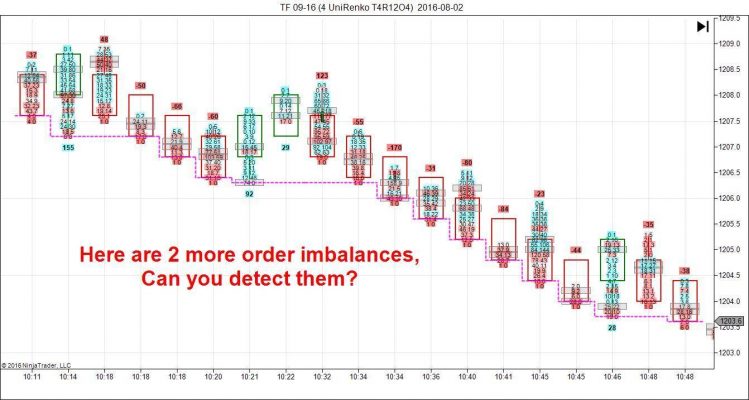

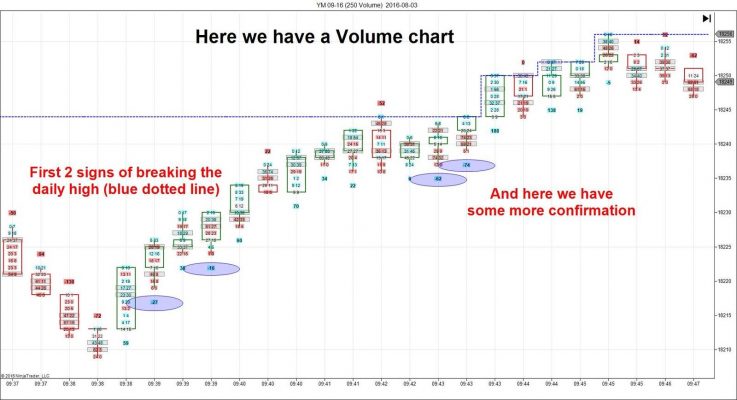

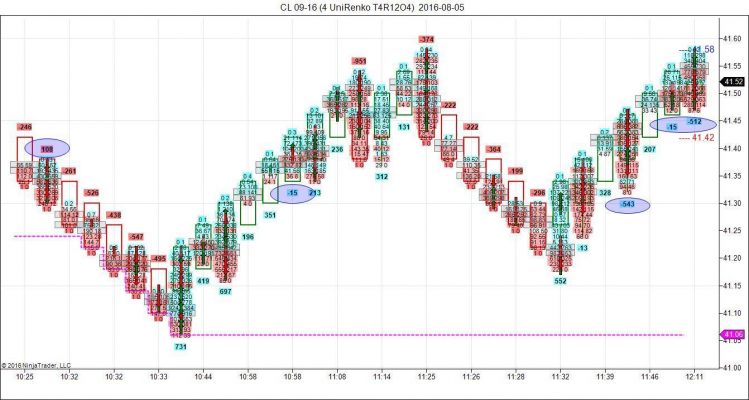

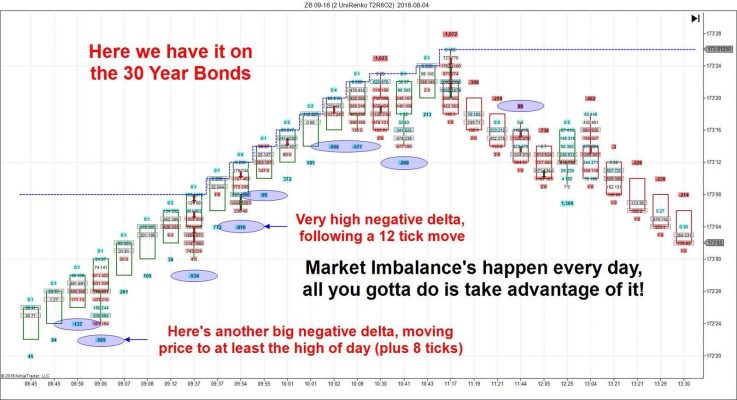

Trading order-flow is one of the only ways you can really “see inside the bars.” Buying and selling pressure is much easier to spot when it’s right there in the numbers in front of you, printing in real-time. The OrderFlow software makes pressure imbalances obvious and precise where range and candle patterns can be ambiguous and even misleading.

Stop using arbitrary look-back indicators. What’s so important about the close price of the last 5 periods? The last 10? That’s just ridiculous – and you know it!

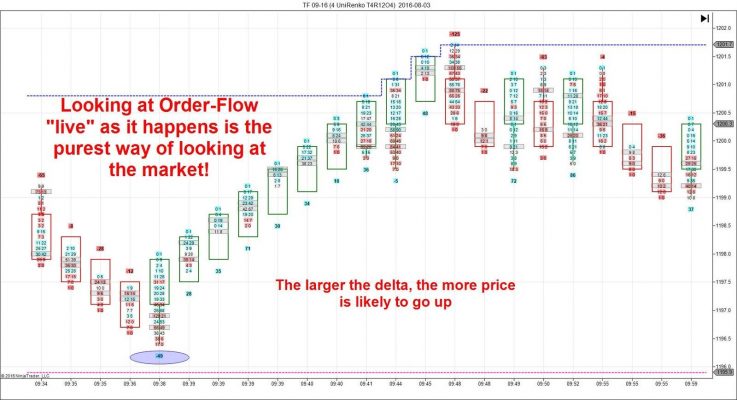

See the market auction walk-forward in real time! There is no better way to get a handle on the trading action. The OrderFlow software helps reveal which side is winning the battle right now as it happens. Real-time market sentiment displayed in a logical way, so you can be better prepared to make consistent winning trades.

By using the OrderFlow software, you will be able to get:

- Enhanced targets for entries & exits

- Increased trade assurance

- The true insight on market moves

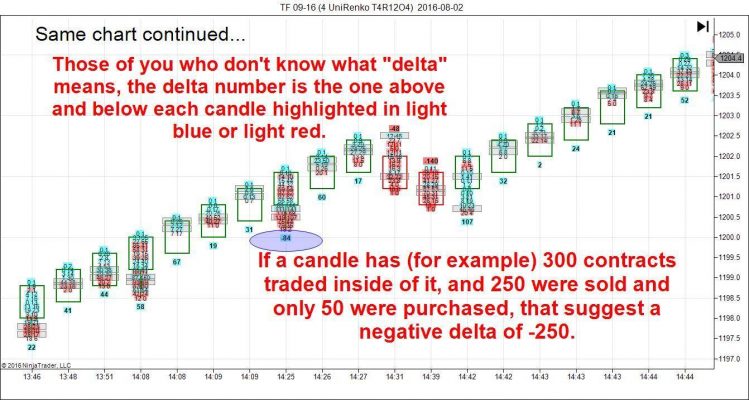

You will be able to see the buy & sell delta. Always know how many buyers vs. sellers there are in each candle.

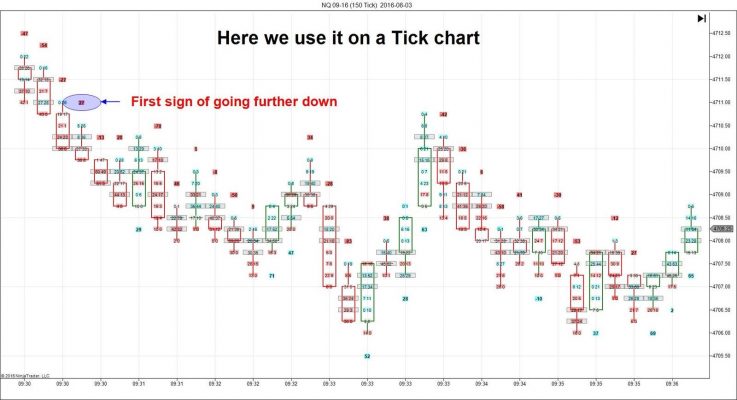

Use it on any bar type you like, whether it’s a 1, 2 or 5-minute bar, Renko bar, Tick or Range bar, it doesn’t matter the least. The buy & sell prints will appear inside all bar types.

If you trade futures, currencies, bonds, commodities and other markets, now is the time to step up your game by shifting to the next evolution of trading!

Using order flow analysis as strategic and tactical weapons to attack the market, you no longer will rely on outdated snapshot views of price movement. Simply follow the auction and trade on the right side of the bid and ask.

This is a real, professional-level trading software and can easily be loaded onto your Ninjatrader platform in a matter of seconds. Please note, this will NOT work on Tradestation, Metatrader or any other charting software. You will need Ninjatrader 7.

Please note: do not use Interactive Brokers data or other filtered data feeds for order flow analysis as they do not provide true order flow as it happens but only provide snapshots of the real thing! Kinetick, Continuum, CQG, Rithmic and DTN.IQ Feed are the top data providers I recommend for order flow analysis.