Relative Volume

The Relative Volume (AVR) is a contextual volume analysis study intended to help you understand 3 distinct but related patterns. The AVR is a familiar histogram indicator but with the added feature of a periodic moving average of your choosing. For example, you can place the AVR on 15 minute bars, set the Period to 21 days, and you will see the 21-day moving average of the values on display for each respective 15 minute bar overlaid on the current values. Works on any minute chart of any periodicity. Note that as with every piece of information in trading, all of these patterns must be interpreted in a larger market context.

The AVR has 3 data display styles:

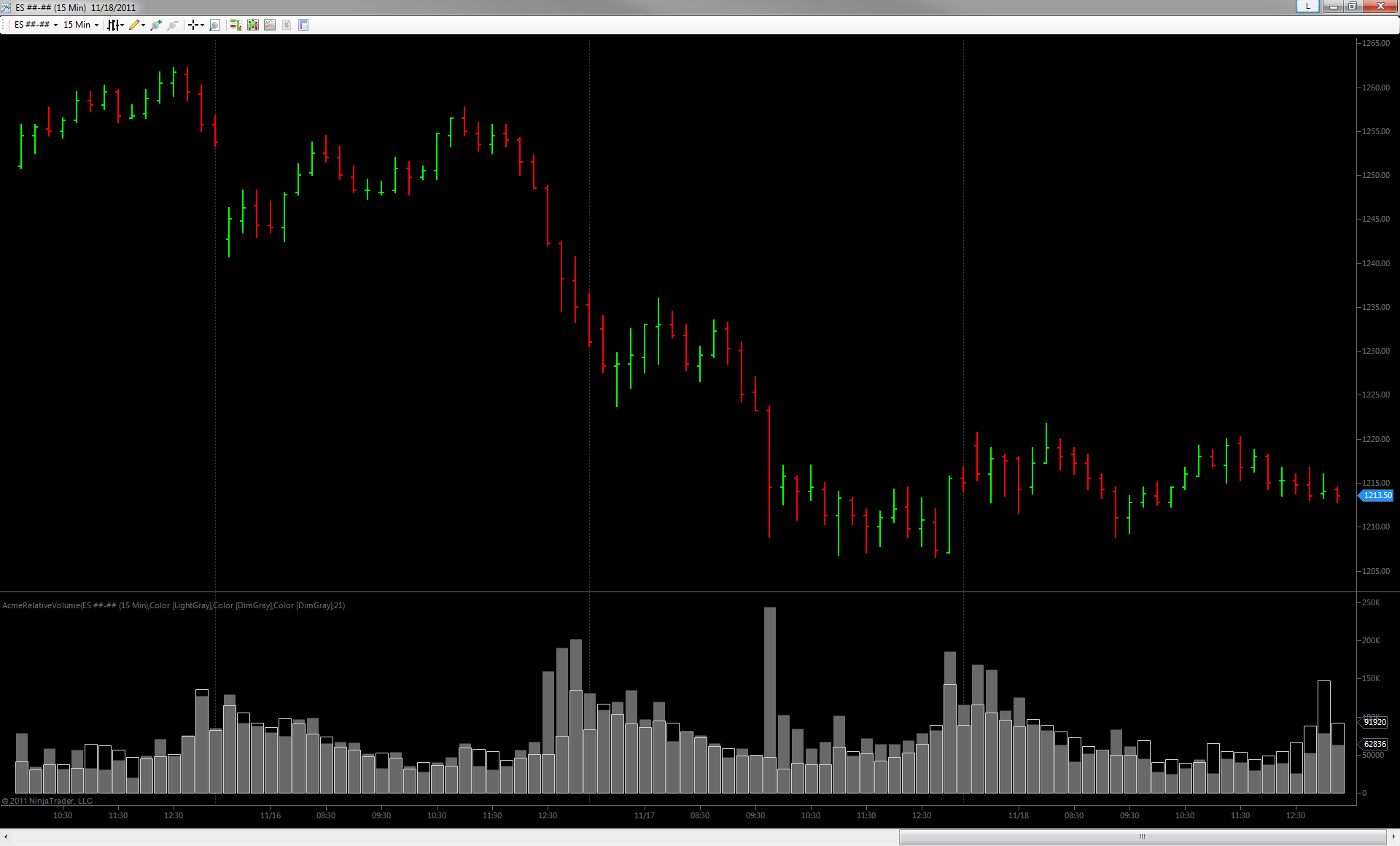

- Volume: displays the current volume for the bar against your chosen periodic moving average. Aids in picking out unusual high or low volume bars relative to bars in that time period in the past.

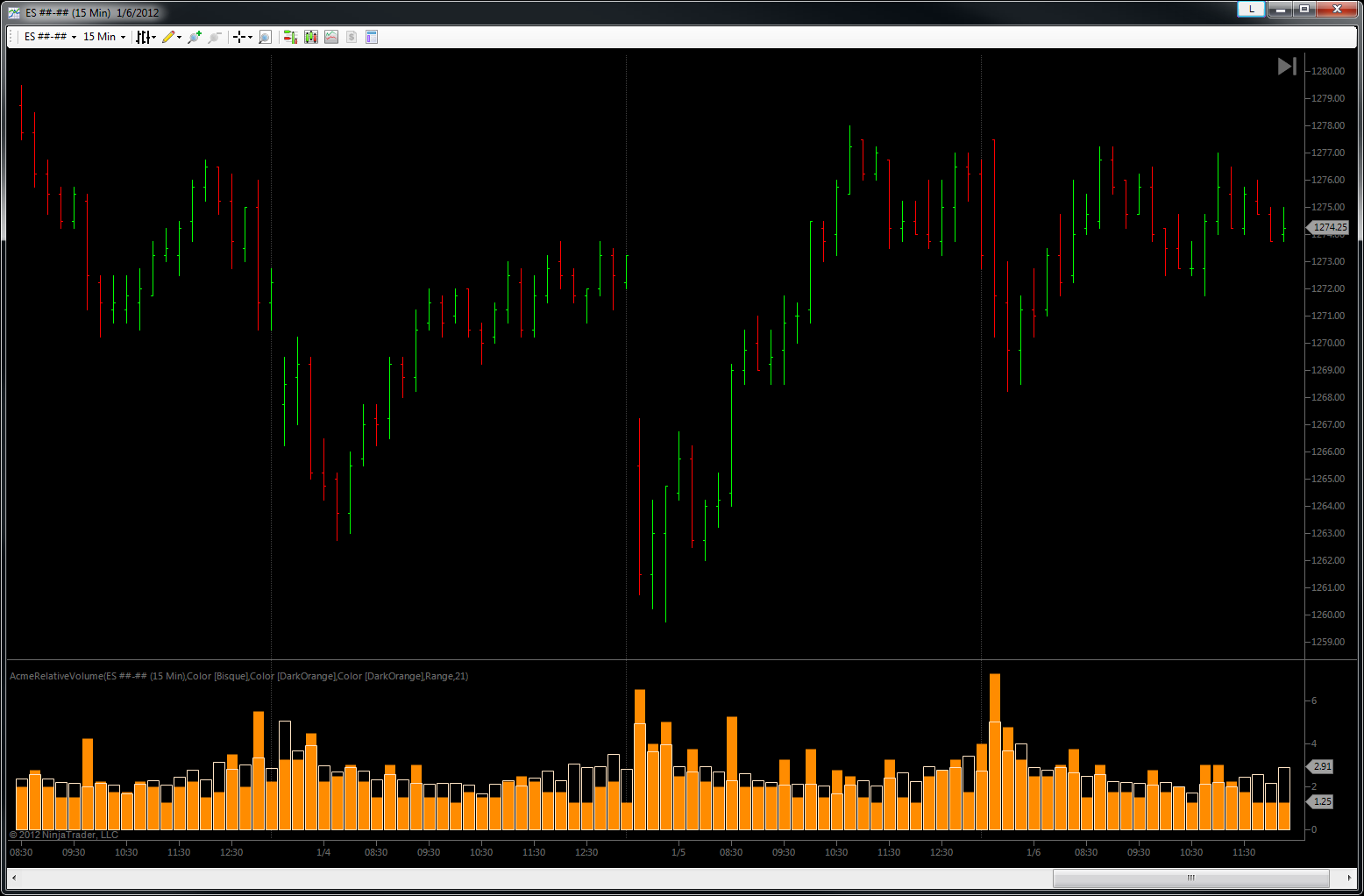

- Range: displays the current range for the bar against your chosen periodic moving average. Aids in picking out unusual high or low bar ranges relative to bars in that time period in the past.

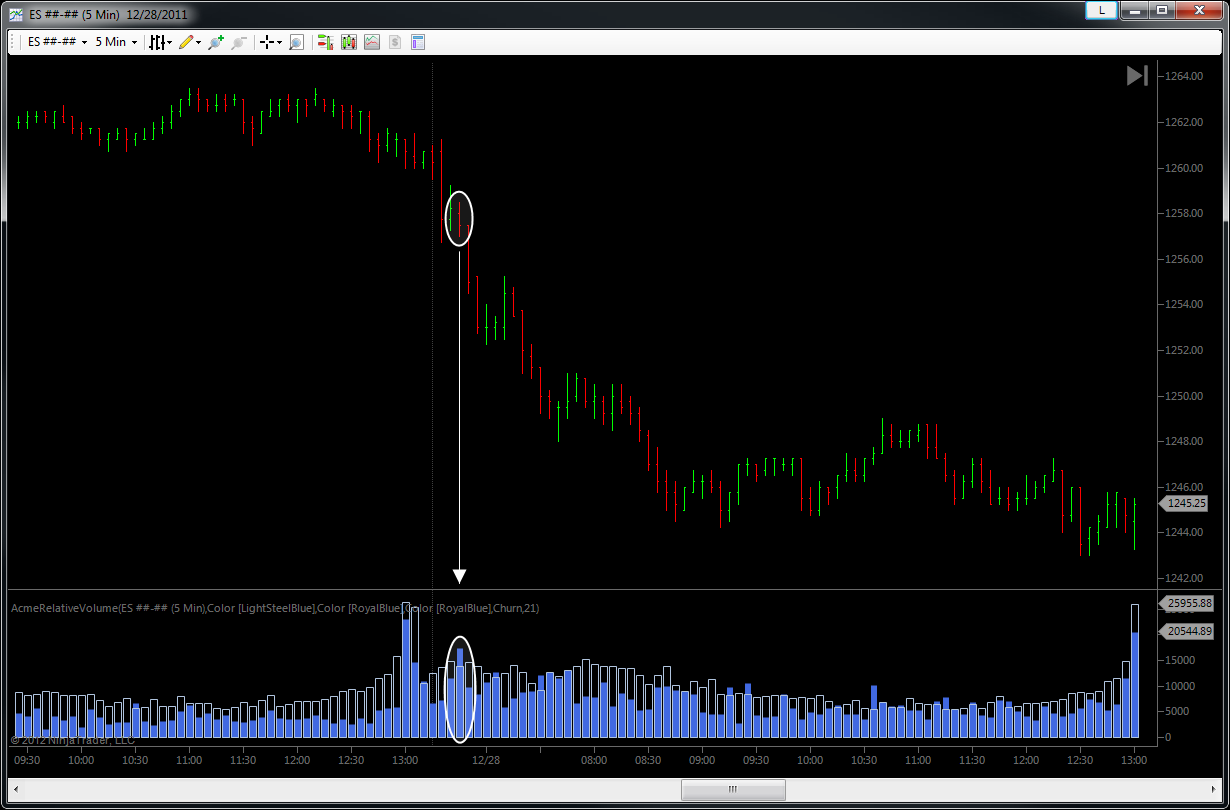

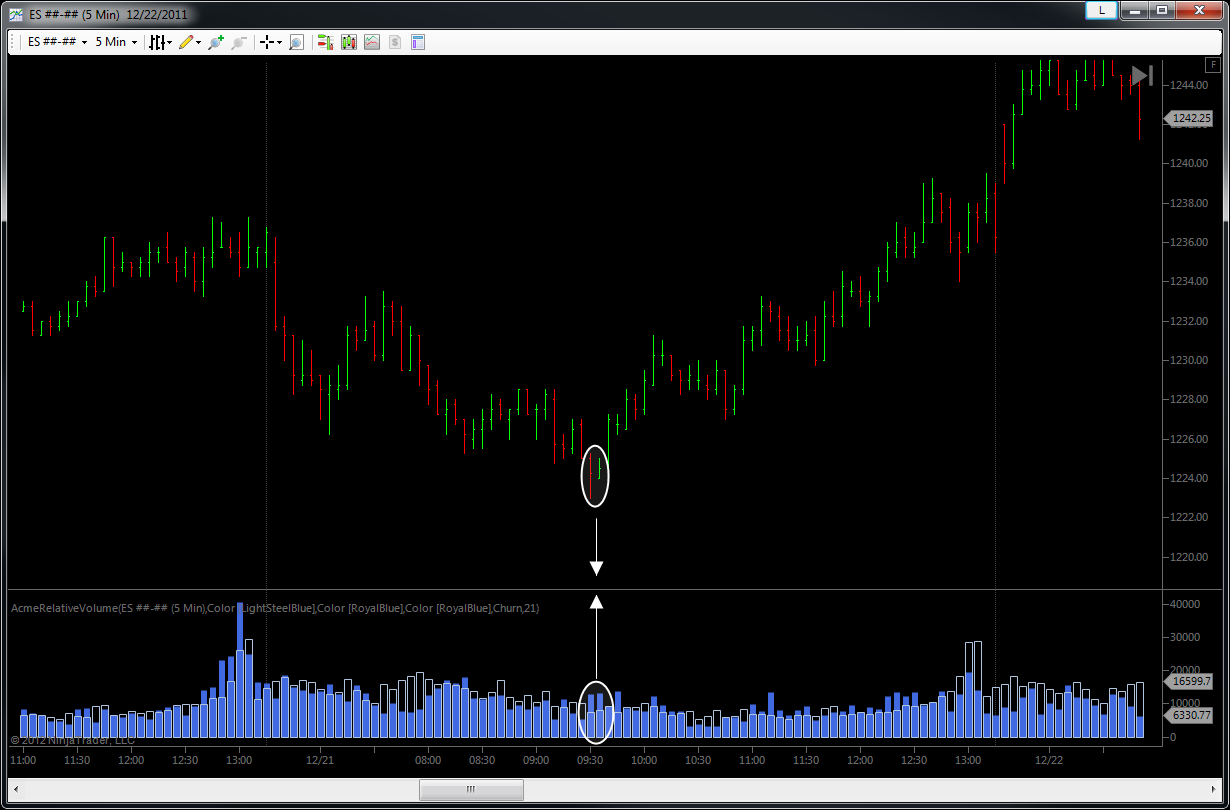

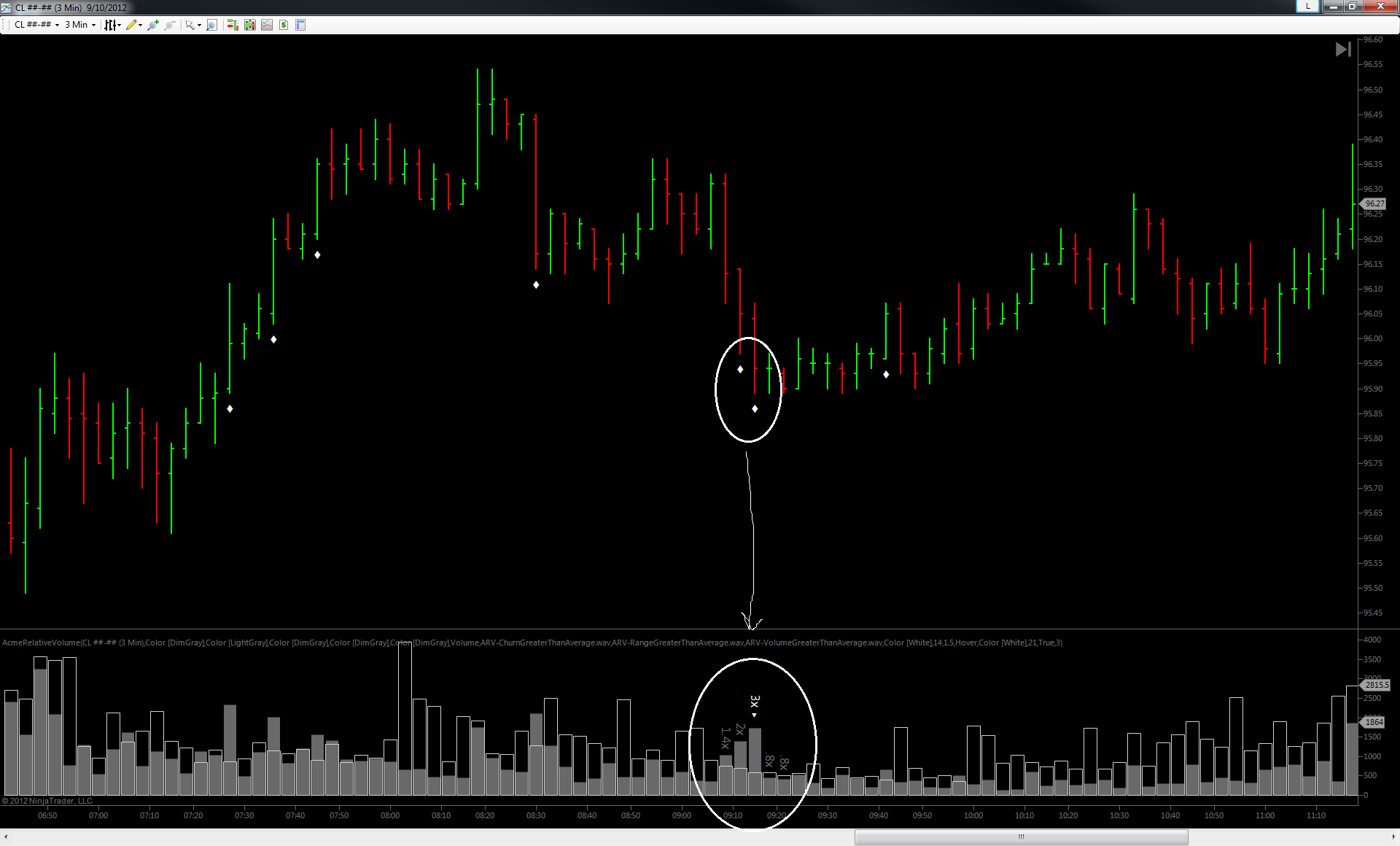

- Churn: displays the current churn – which is volume divided by bar range – of the bar against your chosen periodic moving average. Many traders use churn patterns to help pick out possible turning points in price. So-called “high churn bars” are bars with low range and high volume. 2 examples of such patterns are shown in blue below. While “high churn bars” can indicate opposing forces entering the market, “low churn bars” – that is high range but low volume – can indicate that directional pressure driving the swing or trend is halting and small-size traders are entering late trying to catch a breakout.

Volume

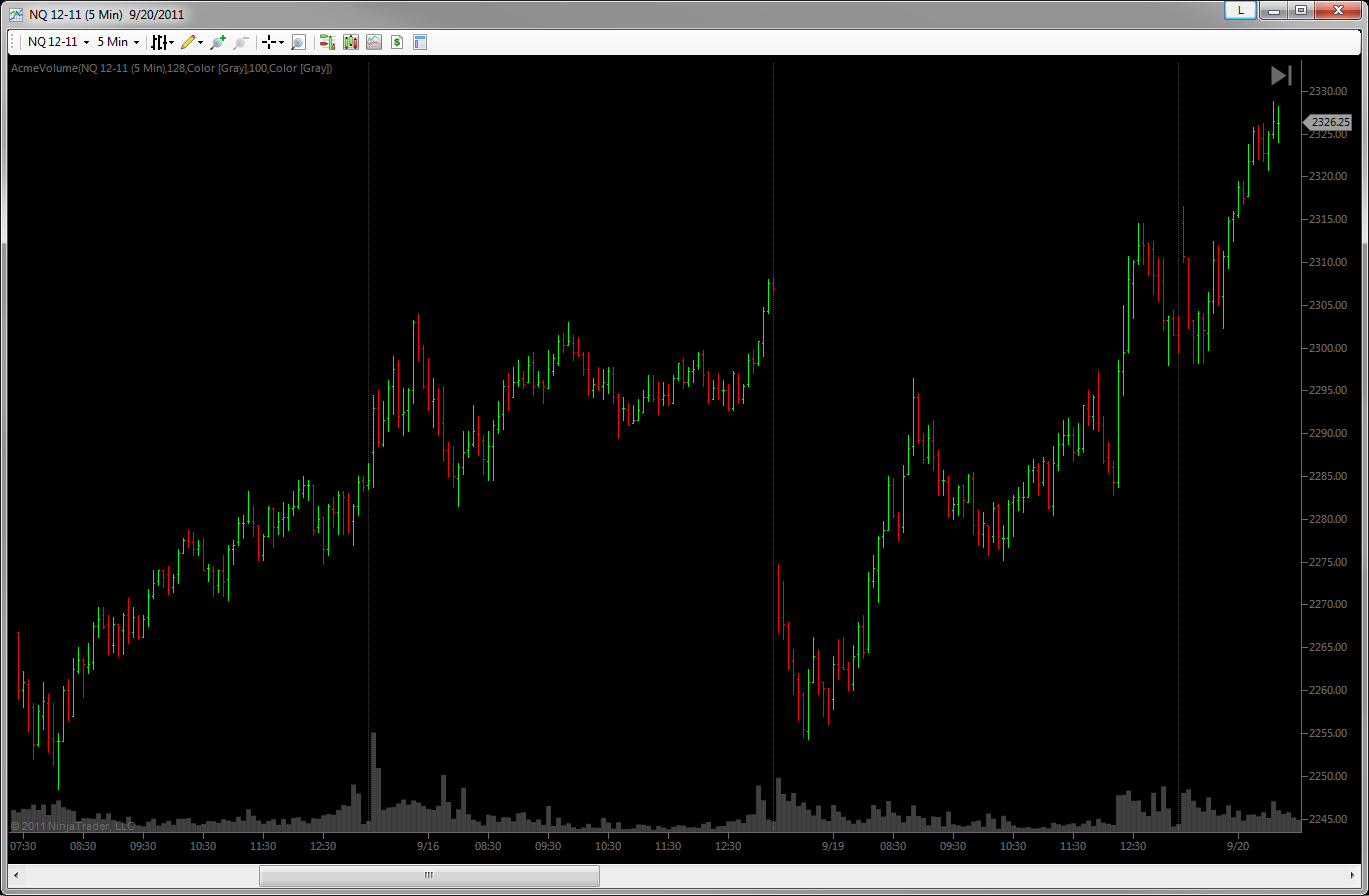

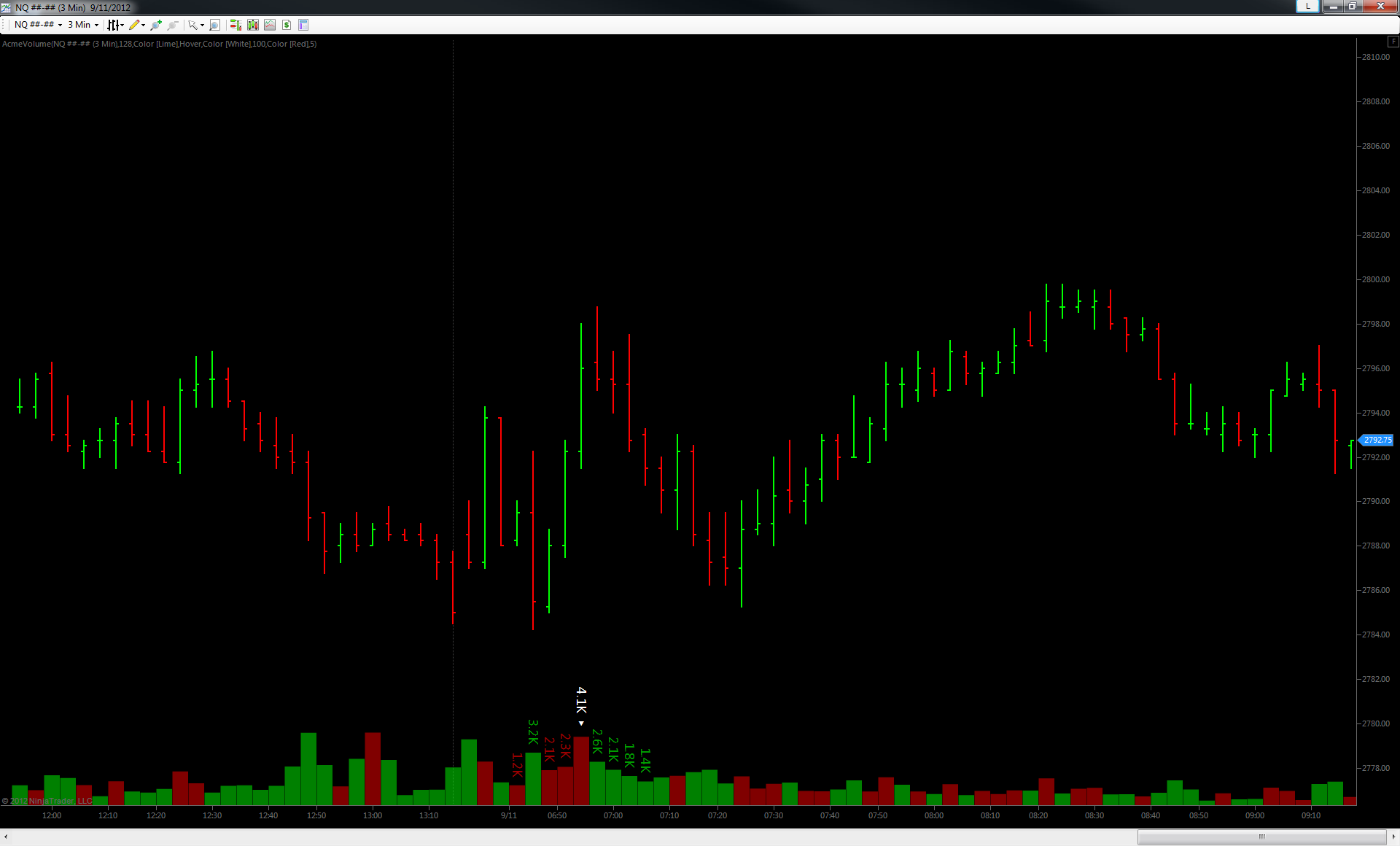

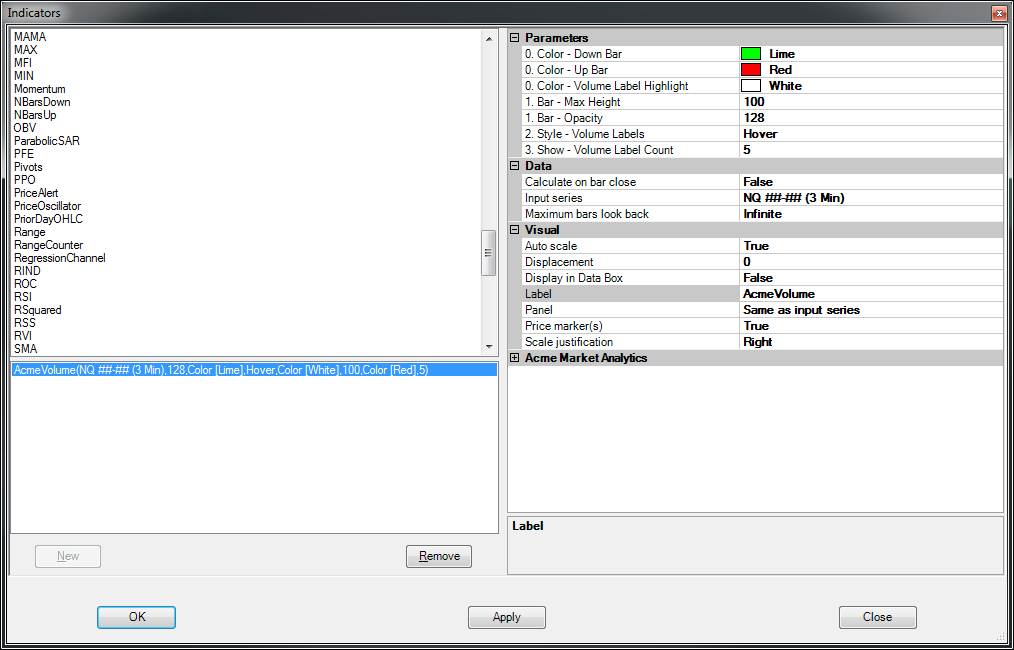

here is a simple indicator that plots the bar volume along the bottom of the chart instead of in a separate panel. It’s a pretty simple thing, really. But saves a lot of horizontal space by not adding another panel to the chart.

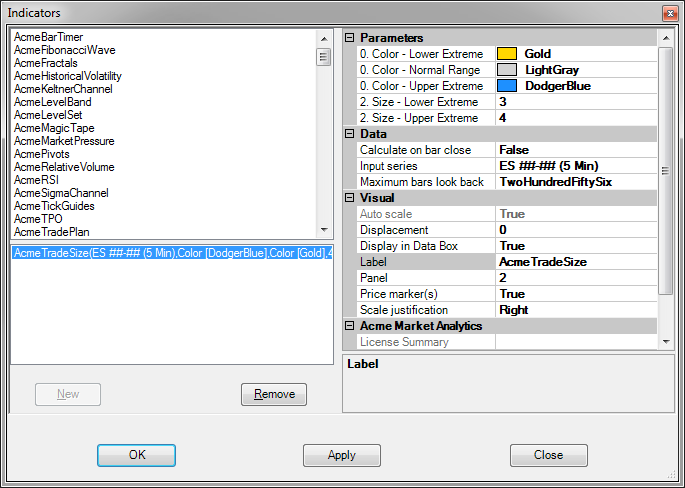

Trade Size

It calculates the average trade size for the bar, then allows you to recolor the bars that are outliers. Essentially, it helps bars that have extraordinary size (large or small) stick out like the proverbial sore thumb. Often big size trades in small-range bars, and often tiny sizes trade in large range bars. You can use this study to help you see “inside the bar” and act accordingly.