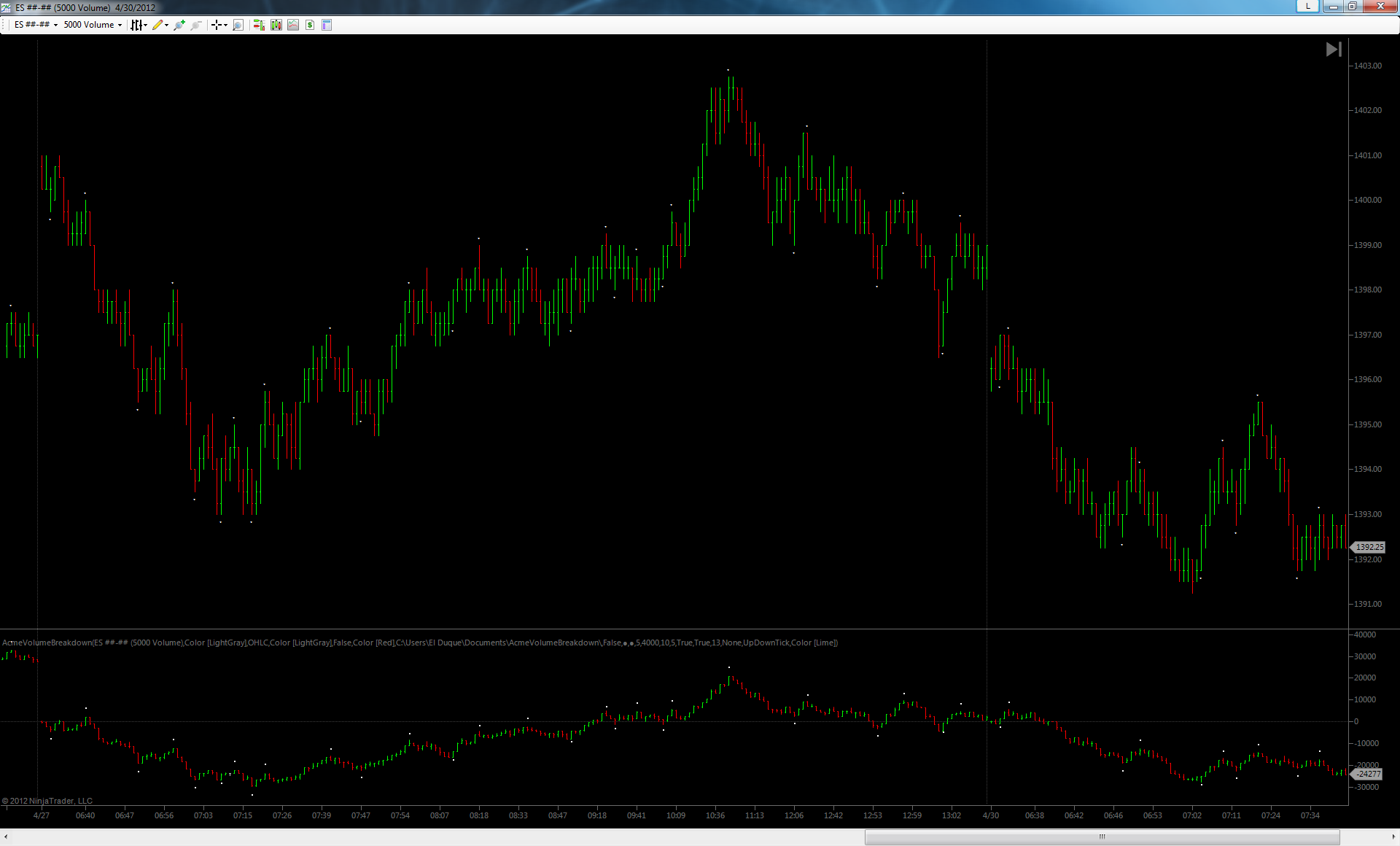

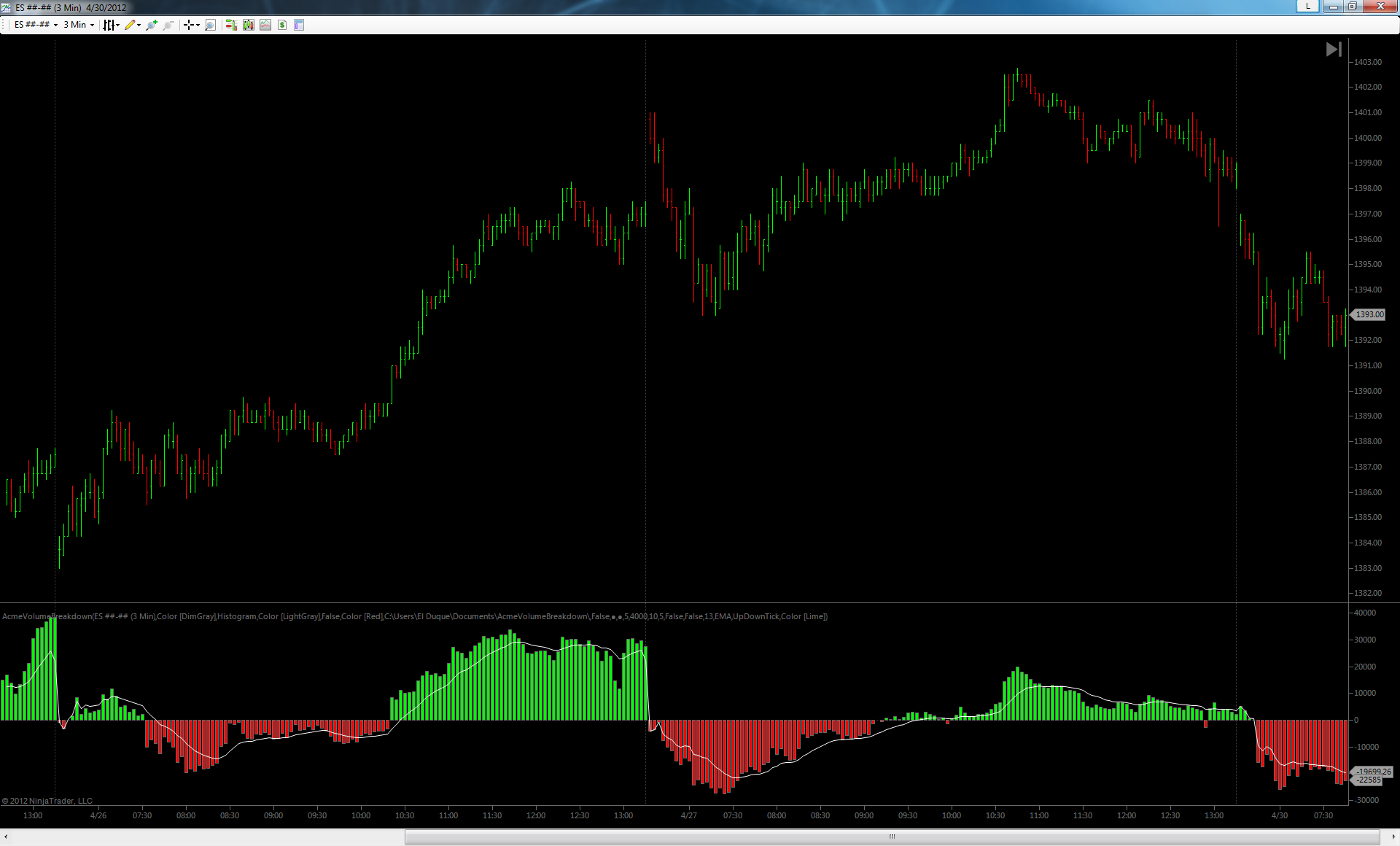

Volume Breakdown

This one should be familiar to most volume profilers. It calculates buying vs. selling pressure for individual bars and accumulates that per-bar differential over an entire session, or longer. This is commonly referred to as a cumulative delta.

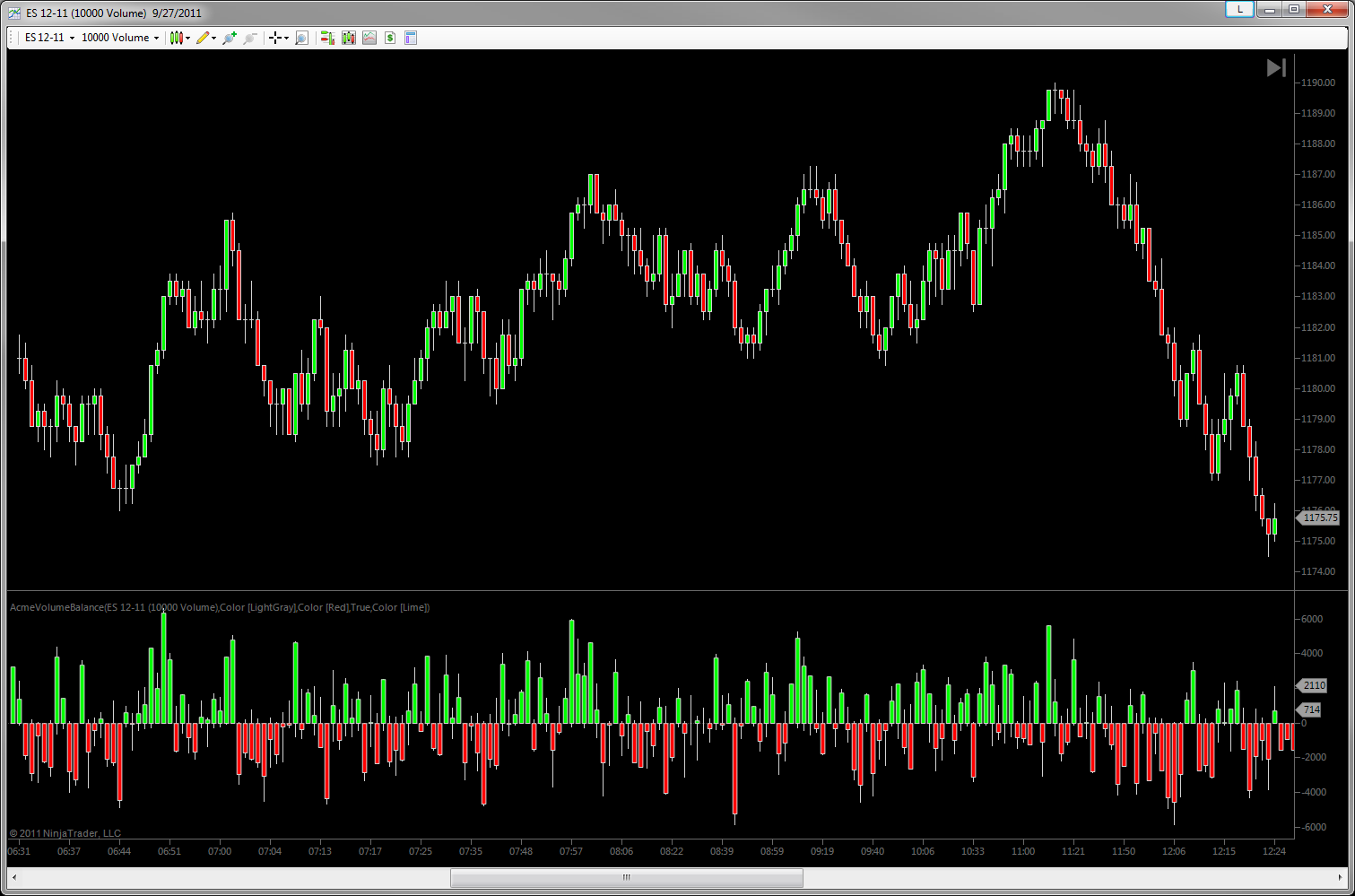

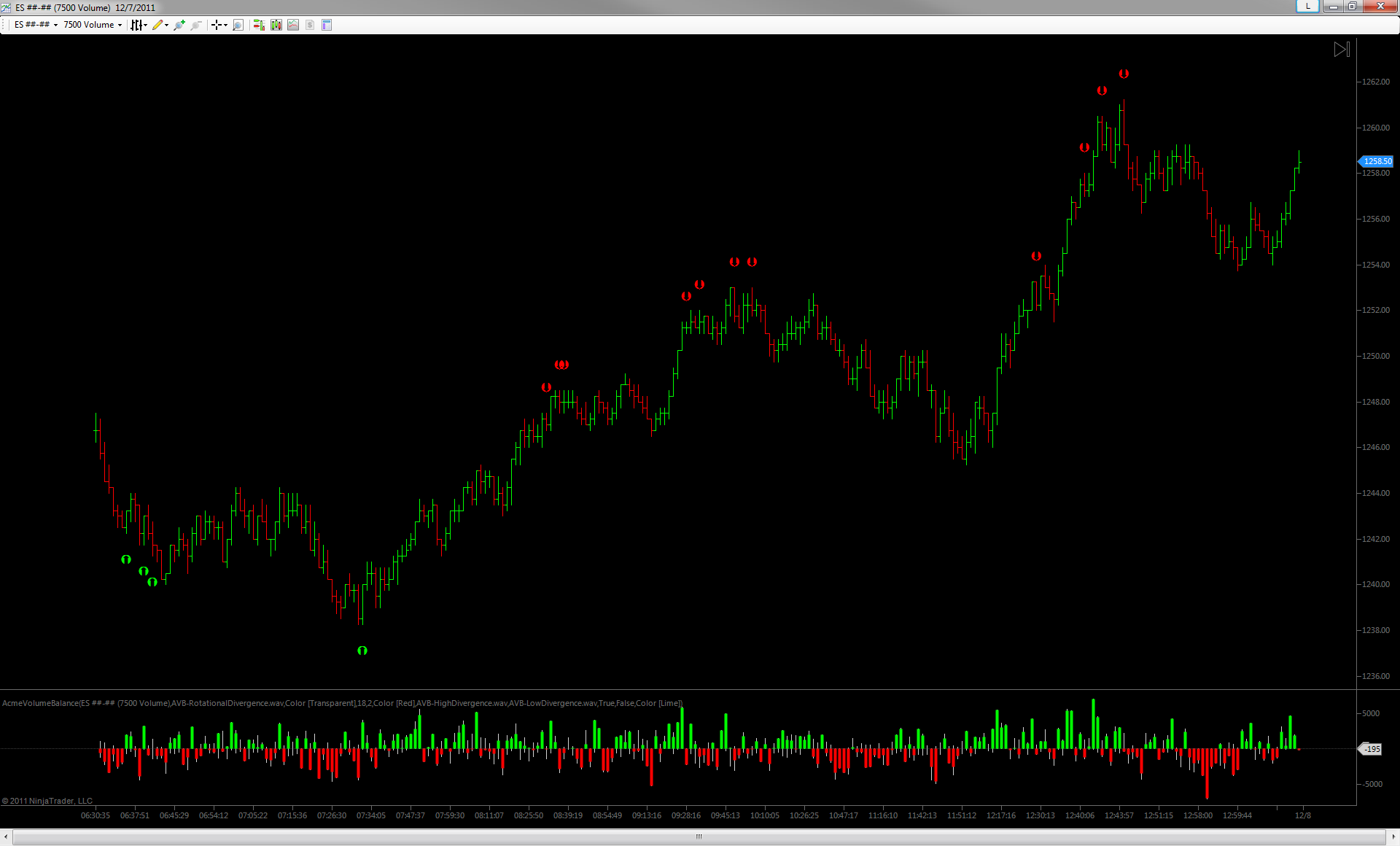

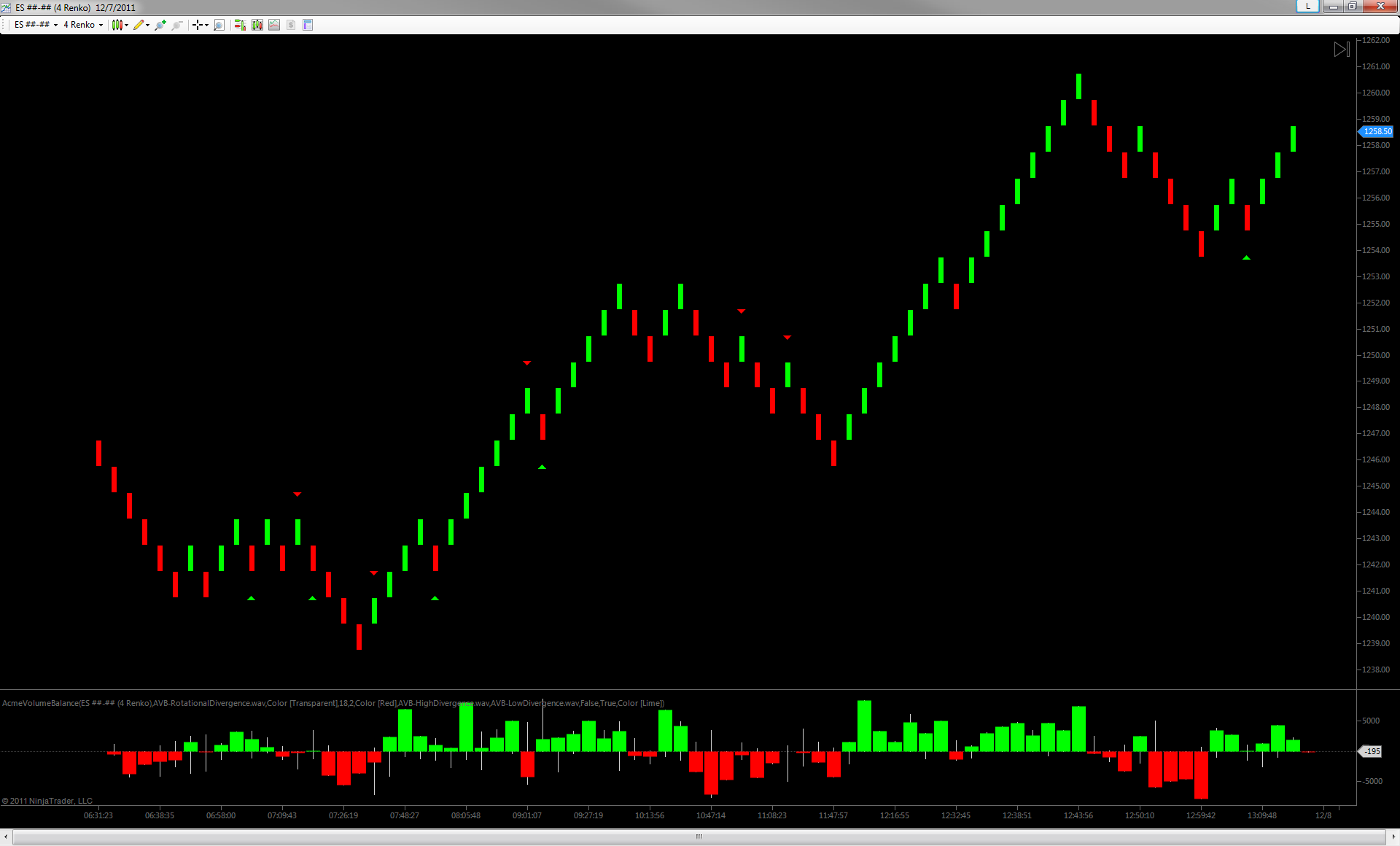

Volume Balance

This one is conceptually similar to Volume Breakdown, except that it does not accumulate volume deltas. Its beauty is in its simplicity -it displays the imbalance in buying and selling pressure within a single bar. The Volume Balance is especially useful Volume Impression charts and charts used for monitoring short-term price swings.

We think one of the best parts of the Volume Balance are it’s tails. Tails show you the range the balance traveled above and below the zero line before arriving at its final value, and are extremely useful for showing you when buying pressure succumbed to selling pressure, or vice versa, within a single bar. So while the breakdown is great for watching price vs. volume agreement and disagreement, the Volume Balance is ideal for spotting reactions at key price levels and potential rotational reversals before they occur.