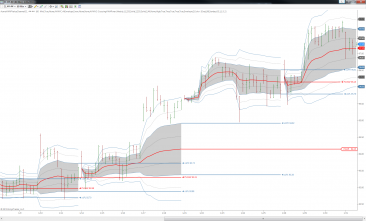

Most folks experienced in intraday stock and futures trading are aware of the VWAP, which stands for Volume-Weighted Average Price. VWAP is important for a couple of reasons. First, market makers’ buy and sell performance is often gauged relative to the day’s VWAP prices, so they tend to take action near it. Second, many accumulation and distribution algorithms are designed to trade at or near the VWAP – or as far away from it as is statistically probable to get the best prices.

VWAP Value Channel

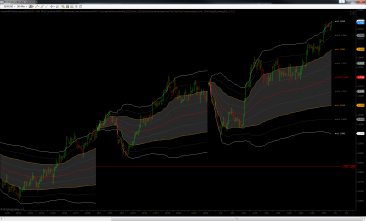

As we said above, that may be overstating the case a bit. But what we can say with certainty is that the VWAP Value Channel is the perfect partner to the Volume Value Channel and TPO Value Channel studies. With this study we offer 3 ways to quantify value based on 3 different though complimentary analysis methods. While you can certainly use any of them individually, since 3 is the magic number, using these studies together can be a hugely powerful help for those of you who define trade-able value levels via confluence.

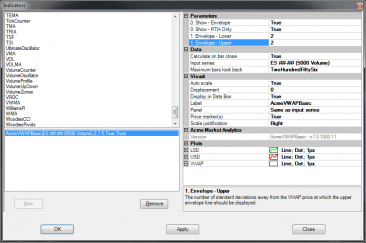

VWAP Basic

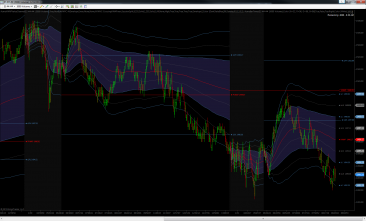

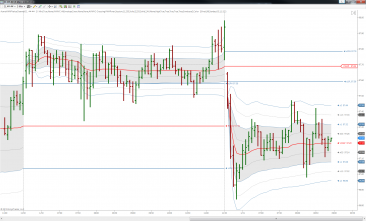

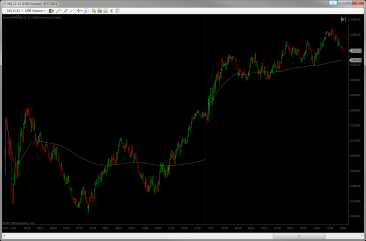

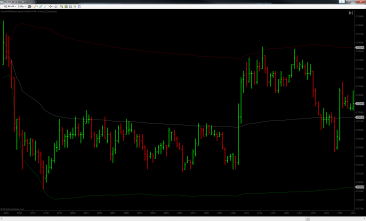

Don’t believe what we said above about the VWAP’s importance and meaning? Have a look at what happened to the NQ’s price action as it touched the second standard deviation under VWAP, pictured in the middle screenshot below. Then notice where it found resistance (twice) and finally support afterward. Seeing should be believing. So if you’re not already tracking VWAP’s position intraday you should at least consider folding it in to your strategy.